Have Home Values Hit Bottom?

Whether you’re already a homeowner or you’re looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling, and that’s raising concerns about a repeat of what happened to prices in the crash in 2008.

One of the questions that’s on many minds, based on those headlines, is: how much will home prices decline? But what you may not realize is expert forecasters aren’t calling for a free fall in prices. In fact, if you look at the latest data, there’s a case to be made that the biggest portion of month-over-month price depreciation nationally may already behind us – and even those numbers weren’t significant declines on the national level. Instead of how far will they drop, the question becomes: have home values hit bottom?

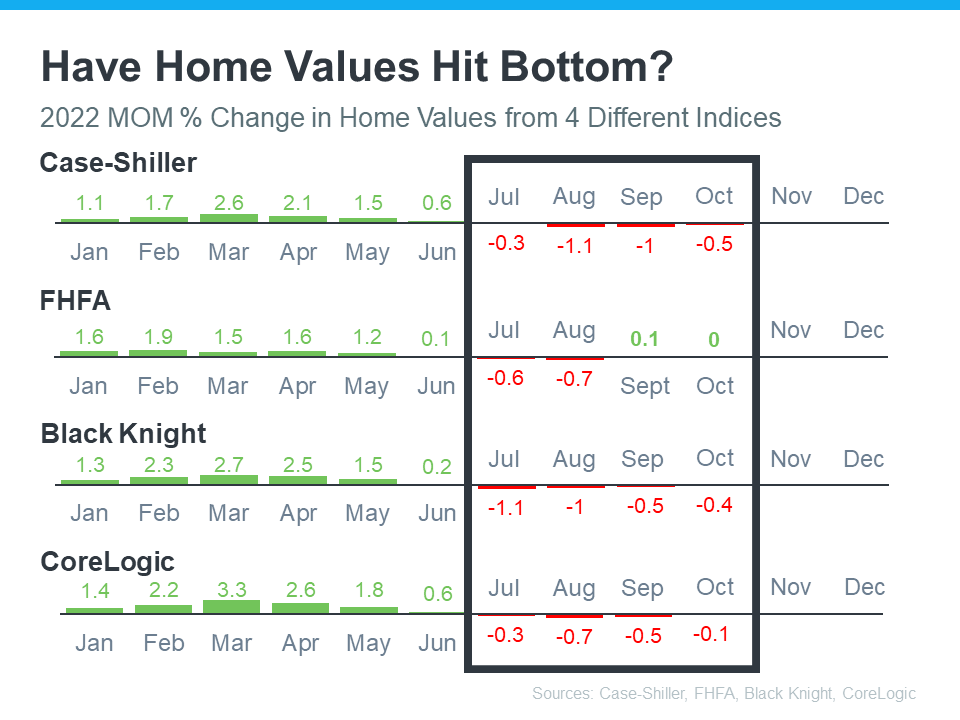

Let’s take a look at the latest data from several reputable industry sources (see chart below):

The chart above provides a look at the most recent reports from Case-Shiller, the Federal Housing Finance Agency (FHFA), Black Knight, and CoreLogic. It shows how, on a national scale, home values have changed month-over-month since January 2022. November and December numbers have yet to come out.

Let’s focus in on what the red numbers tell us. The red numbers are the change in home values over the last four months that have been published. And if we isolate the last four months, what the data shows is, in each case, home price depreciation peaked in August.

While that doesn’t guarantee home price depreciation has hit bottom, it confirms prices aren’t in a free fall, and it may be an early signal that the worst is already behind us. As the numbers for November and December are released, data will be able to further validate this national trend.

Bottom Line

Home prices month-over-month have depreciated for the past four months on record, but there’s a strong case to be made that the worst may be behind us. If you have questions about what’s happening with home prices in our local market, let’s connect.

Categories

- All Blogs (224)

- Affordability (2)

- Appraisal (1)

- Assistance Programs (1)

- Building Wealth (8)

- Buyer Trends (5)

- Buyer's Market (2)

- Buying a Home (12)

- Co-Buying (1)

- Concessions (1)

- Cost of Buying a Home (3)

- Credit Score (1)

- diy tips (2)

- Down Payment (6)

- Economic Update (9)

- Elections (1)

- Federal Reserve (1)

- Fees (1)

- FHA Loan (2)

- First Time Homebuyer (15)

- For Sale By Owner (1)

- Foreclosure (4)

- HOA (1)

- Home Appreciation (11)

- Home Buying Tips (105)

- Home Equity (20)

- Home Loan (16)

- Home Prices (38)

- Home Seller Tips (6)

- Home Selling Tips (71)

- home supply (6)

- Home Values (28)

- Homebuyer Tips (12)

- Homeowner Tips (63)

- Homeowners (38)

- Homeownership Assistance Programs (1)

- House Hunting (4)

- Housing Inventory (14)

- Housing Market Updates (113)

- Loan Programs (2)

- Luxury Homes (1)

- Millennials (3)

- Mortgage Loans (41)

- Mortgage News (35)

- Mortgage Rates (34)

- Mortgage Tips (39)

- Multi-Generational Homes (3)

- New Build (6)

- New Construction (6)

- New Home (7)

- Passive Income (2)

- Pre-Approval (7)

- Pricing Your Home (2)

- Real Estate Investing (3)

- Real Estate Investing Strategy (2)

- Real Estate Investment (1)

- Real Estate Tips (156)

- Recession (1)

- Renting (6)

- Retirement (5)

- Retirement Strategy (1)

- Second Home (1)

- Seller's Market (2)

- Selling Your Home (12)

- Tax Tips (2)

- Taxes (2)

- VA Loans (1)

- Veterans (1)

Recent Posts

23 Buck St. Suite 100 South Fork, Colorado 81154 United States, CO, 81154, USA