Owning Your Home Helps You Build Wealth

You may have heard some people say it’s better to rent than buy a home right now. But, even today, there are lots of good reasons to become a homeowner. One of them is that owning a home is typically viewed as a good long-term investment that helps your net worth grow over time.

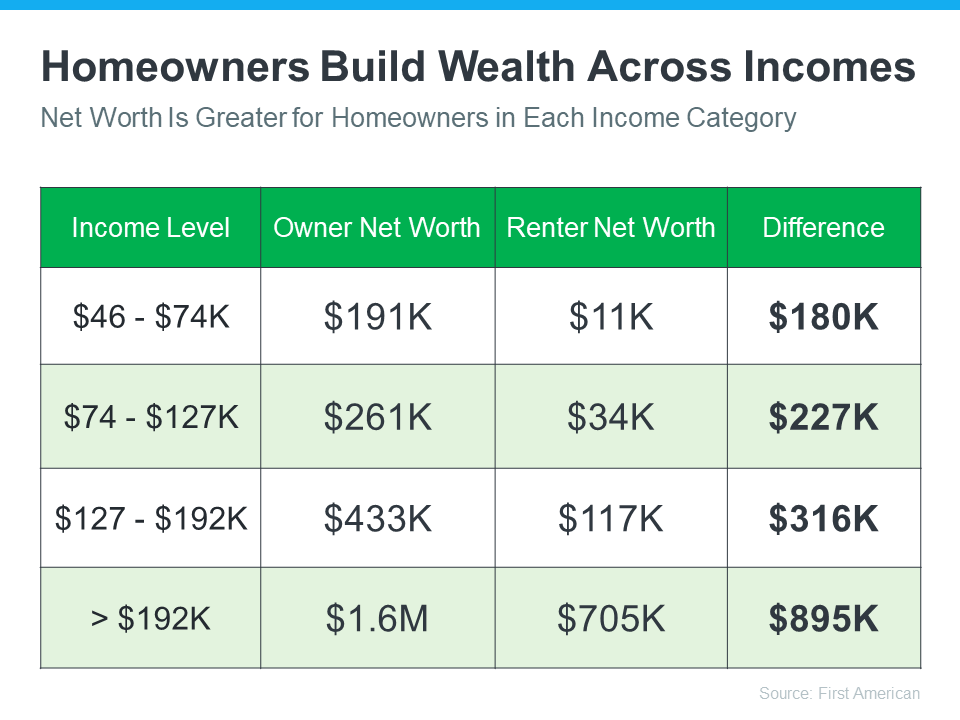

Homeownership Builds Wealth Regardless of Income Level

You may be surprised to learn homeowners across various income levels have a much higher net worth than renters who make the same amount. Data from First American helps illustrate this point (see graph below):

What makes wealth so much higher for homeowners? A recent article from Realtor.com says:

“Homeownership has long been tied to building wealth—and for good reason. Instead of throwing rent money out the window each month, owning a home allows you to build home equity. And over time, equity can turn your mortgage debt into a sizeable asset.”

Basically, the wealth you accumulate when you own a home has a lot to do with equity. As a homeowner, equity is built up as you pay down your loan and as home prices appreciate over time. Mark Fleming, Chief Economist at First American, explains how this same benefit isn’t true for renters in a recent podcast:

“Renters as non-homeowners gain no wealth benefit as home prices rise. That wealth actually accrues to the landlord.”

Before you decide to sign another rental agreement, now is a good time to think about whether it would be better for you to buy a home instead. The best way to figure out what makes sense for you is to have a conversation with a real estate expert you trust. That professional can talk you through the benefits that come with owning to determine if that’s the right next step for you.

Bottom Line

If you're not sure whether to keep renting or to buy a home, know that owning a home, no matter how much money you make, can help build your wealth. Let's connect now to get started on the path to homeownership.

Categories

- All Blogs (224)

- Affordability (2)

- Appraisal (1)

- Assistance Programs (1)

- Building Wealth (8)

- Buyer Trends (5)

- Buyer's Market (2)

- Buying a Home (12)

- Co-Buying (1)

- Concessions (1)

- Cost of Buying a Home (3)

- Credit Score (1)

- diy tips (2)

- Down Payment (6)

- Economic Update (9)

- Elections (1)

- Federal Reserve (1)

- Fees (1)

- FHA Loan (2)

- First Time Homebuyer (15)

- For Sale By Owner (1)

- Foreclosure (4)

- HOA (1)

- Home Appreciation (11)

- Home Buying Tips (105)

- Home Equity (20)

- Home Loan (16)

- Home Prices (38)

- Home Seller Tips (6)

- Home Selling Tips (71)

- home supply (6)

- Home Values (28)

- Homebuyer Tips (12)

- Homeowner Tips (63)

- Homeowners (38)

- Homeownership Assistance Programs (1)

- House Hunting (4)

- Housing Inventory (14)

- Housing Market Updates (113)

- Loan Programs (2)

- Luxury Homes (1)

- Millennials (3)

- Mortgage Loans (41)

- Mortgage News (35)

- Mortgage Rates (34)

- Mortgage Tips (39)

- Multi-Generational Homes (3)

- New Build (6)

- New Construction (6)

- New Home (7)

- Passive Income (2)

- Pre-Approval (7)

- Pricing Your Home (2)

- Real Estate Investing (3)

- Real Estate Investing Strategy (2)

- Real Estate Investment (1)

- Real Estate Tips (156)

- Recession (1)

- Renting (6)

- Retirement (5)

- Retirement Strategy (1)

- Second Home (1)

- Seller's Market (2)

- Selling Your Home (12)

- Tax Tips (2)

- Taxes (2)

- VA Loans (1)

- Veterans (1)

Recent Posts

23 Buck St. Suite 100 South Fork, Colorado 81154 United States, CO, 81154, USA